Primer: What is private credit direct lending?

Private credit is a term used to refer to investor capital that private funds loan to businesses or other projects. Some of the ways loans can be provided include direct lending, syndicated loan financing, and collateralized loan obligations (CLOs).

This is an overview of direct lending, an important part of the private credit ecosystem that enables the growth of small- and mid-sized businesses and generates returns for institutional investors, including pensions, foundations, endowments, and banks.

What is direct lending?

Private credit is an asset class that focuses on nonbank lending, including to small- and mid-sized companies who need access to capital. Direct lending, a type of private credit, is the term used to describe privately negotiated, direct loans. For the lender, the loan is an illiquid asset that offers a potentially high yield and spans a range of risk/return scenarios. For the borrower, it constitutes needed capital that otherwise may be unavailable.

Direct lending arrangements can range from senior secured loans for large established corporate borrowers, to junior unsecured financing such as construction loans for a real estate development, to loans in niche areas such as airplane leasing or software companies. Private credit can also be extended to companies in distressed situations. Types of private credit include:

Senior, secured: Lending that is senior to more junior tranches and has a relatively lower credit risk than other forms of private debt

Mezzanine: Lending to companies that have a subordinated position to more senior loans; mezzanine loans tend to offer higher yields

Special situations: Lending to finance an unusual corporate event such as a spinoff, tender offer, bankruptcy, or litigation

Distressed: Lending to companies undergoing material challenges

Venture: Lending designed specifically for early-stage, high-growth companies with venture capital backing

Real estate: Lending for income-producing properties, such as shopping malls, office complexes, or hotels

Infrastructure: Lending linked directly to projects such as toll roads or bridges; also know as project finance

Private loans are not traded on public markets. However, private credit portfolios can be constructed much like securities portfolios and can be designed for a wide variety of investment needs and risk tolerances.

Public credit and private credit – substantive differences

Public credit and private credit are often perceived as comparable asset classes, as they both provide income to the lender in the form of interest payments. There are, however, important differences. Unlike broadly syndicated loans or bonds, private bilateral loans are not publicly traded and lack observable prices.

Private credit loans can provide several benefits over public market financings, as these loans:

Typically have floating rates, protecting lenders (and their investors) against interest rate risk

Are typically senior to other forms of indebtedness, often secured against the assets or future revenues of the borrower

Include covenants more protective of lenders in comparison to broadly syndicated loans or unsecured high yield bonds

Have shorter durations, such as five to seven years, and are frequently restructured, refinanced, or revised prior to maturity

Are typically held to maturity

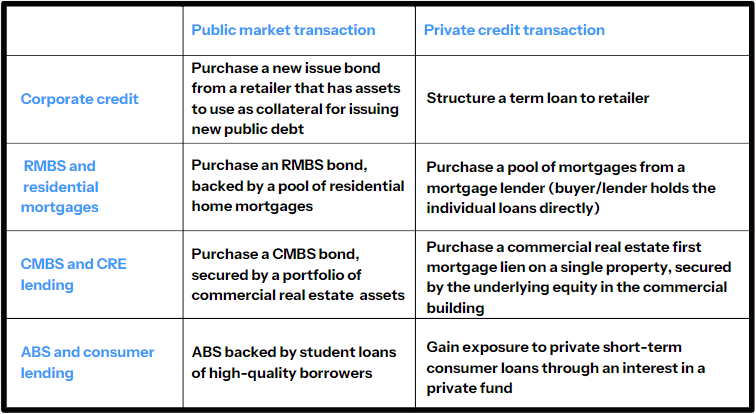

The following table presents a comparison of public and private financing examples:

Evolution of the direct lending market

The private debt market has grown considerably since the Global Financial Crisis of 2007-2008 for several reasons. Banks have decreased lending to middle-market companies due to increased bank capital requirements. Smaller companies also have found it more challenging to access public markets as the size of loan syndication deals has increased. Direct lenders such as investment managers (including, in some cases, affiliates of the very banks that have withdrawn from this market) and other institutional buyers, such as pension funds and foundations, have stepped in to fill the gap. Direct lending has also grown in popularity for borrowers because these lenders can provide greater flexibility, expertise, certainty, and speed compared to traditional lenders.

Distribution of private credit fund investments

Private credit funds are typically structured as limited partnerships or LLCs offering interests in a fund by means of a private placement to qualified investors. Investors are sophisticated, typically institutional investors (at a minimum, “qualified purchasers” under the securities laws) that agree to longterm investment periods (typically 5-7 years). Large institutional clients (e.g., foundations, endowments, pension funds) also may extend credit directly to a borrower rather than invest in a managed private credit fund.

Regulation of private, direct loans

Application of securities laws to loans

Private credit transactions are loans – not securities – for purposes of the federal and state securities laws. The loans are not publicly traded, nor are they offered to the public – they are bespoken between lender and borrower and documented by a loan agreement. In the context of a private credit fund, the fund is extending credit to a borrower and receives interest payments pursuant to the loan agreement between the fund (as lender) and borrower. Private credit extended to natural persons remains subject to existing federal and state consumer protection laws.

Offer and sale of fund interests

The non-public offer and sale of fund interests is exempt from SEC registration under Regulation D of the Securities Act. The fund and its manager are obligated under federal and state securities laws to disclose information in the fund’s private placement memorandum about the risks of investment in the fund and its portfolio, including liquidity and valuation risks and any lock-up periods.

Regulation of creditors

An investment adviser managing a private credit fund is registered with and regulated by the SEC under the Investment Advisers Act of 1940. Advisers engaged in direct lending are subject to the full array of SEC regulatory and examination requirements. If the investment adviser also invests in derivatives, it is further regulated by the CFTC and the National Futures Association. The adviser is required to make detailed disclosure of its practices in its Form ADV and provide information to regulators about loans on its Form PF.

Systemic risk

Private credit funds are not systemically risky. The funds are not backed, insured, or guaranteed by the federal government. Taxpayer money is not at risk in times of fund stress. Liquidity risk is not an issue for private credit funds, as the funds receive capital from sophisticated investors who commit their investments to the funds for multi-year holding periods—unlike mutual fund investors who typically have daily liquidity rights or bank depositors who can withdraw money at any time. This prevents runs on a fund and provides long-term stability to borrowers and other investors. Private credit funds present no contagion risk to other funds or the economy. If a fund fails, the losses are borne by that specific fund’s adviser and investors and do not have the capacity to affect other funds and the broader financial system.