Private credit

Private credit is a term used to refer to investor capital that private funds loan to businesses or other projects. Some of the ways loans can be provided include direct lending, syndicated loan financing, and collateralized loan obligations (CLOs).

This is an overview of CLOs, an important part of the private credit ecosystem that enables the growth of small- and mid-sized businesses and generates returns for institutional investors, including pensions, foundations, endowments, and banks.

What is a collateralized loan obligation (CLO)?

A CLO is a type of collateralized debt obligation that enables investors to purchase interests in a diversified portfolio of corporate loans. The entity managing the CLO, typically an investment manager or bank, will purchase several corporate loans and construct a loan portfolio. The underlying loans will be of various credit risks, maturities, and industries, and the CLO manager will package them into a marketable security. The loans are usually first-lien bank loans to businesses, but also may include lower-rated business loans, distressed loans, or loans to fund leveraged buyouts. The loans are purchased from a variety of sources, but predominately from bank lenders (i.e., syndicated bank loans).

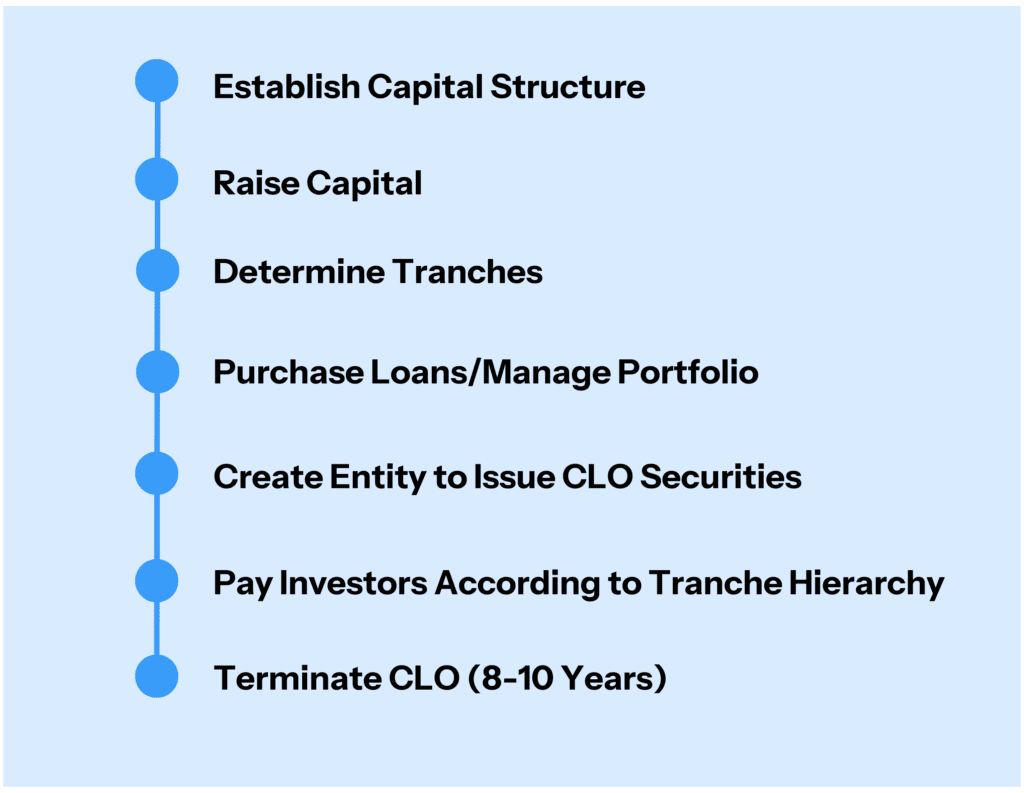

The CLO manager raises capital from institutional investors to acquire the underlying loans and holds the underlying loans in a pooled vehicle such as a special purpose vehicle (SPV). The time when the portfolio is being constructed, often referred to as the warehousing period, may take several weeks. Once the loan portfolio is constructed, the CLO manager through its registered agent sells various tranches of the CLO – each with its own pre-defined risks, seniority, and payouts. The institutional investors choose the tranche that is most suitable for them. The CLO receives the underlying interest payments and pays the CLO investors pursuant to the tranche hierarchy.

CLOs are actively managed: the CLO manager can buy and sell underlying loans to generate returns and/or minimize losses. A CLO may hold anywhere from 100-250 underlying loans and have a lifespan typically of 8-10 years. The underlying loans usually are secured by borrower assets as collateral, which mitigates liquidation and market volatility risks.

CLO tranches

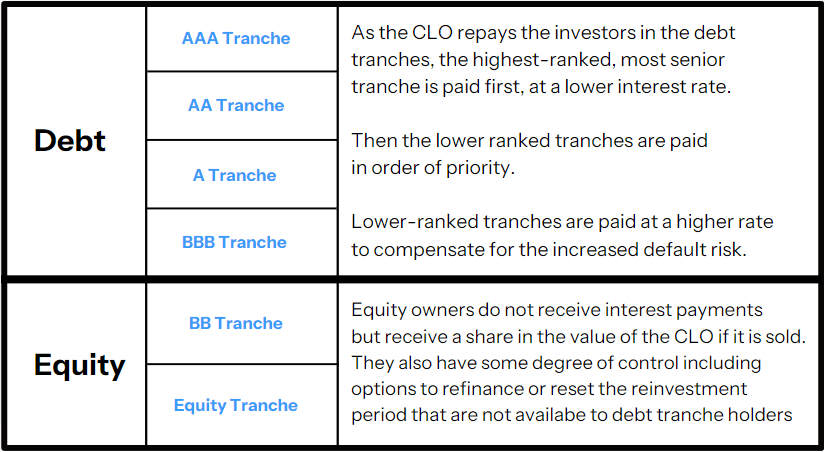

Debt tranches in a CLO have their own pre-defined credit ratings and interest payment schedules. Lower-ranked tranches have greater credit risk and higher potential returns. Equity tranches are unrated and paid out after all debt tranches are repaid and represent an ownership interest in the underlying collateral:

CLOs: Different than syndicated

loans, collateralized mortgage obligations (CMOs), or private credit

CLOs may resemble other types of debt offerings but differ in significant ways:

CLOs differ from syndicated loans because a syndicated loan is not a security. Syndicated loans are offered by a group of lenders, or syndicate, to a single corporate borrower for a corporate purpose, where a CLO is a type of security where investors purchase an interest in a diversified portfolio of loans. A CLO may buy loans that were previously part of a syndicate, which mitigates credit risk of syndicating banks by shifting the liabilities away from the lending bank in favor of the institutional investors in the CLO.

CLOs also differ from CMOs, as the loans underling CLOs are corporate debt and the loans underlying CMOs are mortgage loans.

CLOs also differ from direct lending. A CLO is a package of loans, as opposed to a bilateral loan between private credit fund and borrower, and CLO shares trade in the secondary market, where a private credit loan is illiquid.

CLO creation process1

Regulation of CLO

Application of securities laws to underlying loans

The underlying CLO portfolio loans are loans – not securities – for purposes of the federal and state securities laws. The underlying loans are documented with loan documents, not offered to the public, and only traded on the secondary institutional markets. The CLO buys the loan from a bank or other lender and assumes the right to interest payments pursuant to the original loan agreement.

Offer and sale of fund interests

The non-public offer and sale of fund interests is exempt from SEC registration under Regulation D of the Securities Act (at least “qualified purchasers” under the securities laws). The fund and its manager are obligated under federal and state securities laws to disclose information in the private placement memorandum about the risks of investment in the fund, including the tranche hierarchy, liquidity and valuation risks, and any lock-up periods.

Regulation of CLO manager

An asset manager acting as CLO manager is registered with and regulated by the SEC under the Advisers Act (the manager typically invests in securities in addition to constructing and managing CLO loan portfolios). Advisers that manage CLOs are subject to the full array of SEC regulatory and examination requirements. If the asset manager uses derivatives, it

is further regulated by the CFTC and the National Futures Association (NFA). The asset manager also is required to make detailed disclosure of its practices in its Form ADV and provide information about loans to regulators on its Form PF. Bank-affiliated CLO managers remain subject to prudential banking regulation.

Valuation

CLO portfolio loans that were syndicated generally trade on the secondary market; other underlying loans may be less liquid. Although less common, some CLO portfolio loans may be illiquid and must be fair valued by the CLO manager (often with the assistance of a third-party valuation expert). CLOs themselves are not without liquidity risk but CLO tranches often trade in the secondary market with observable prices.

Systemic risk

CLO funds are not backed, insured, or guaranteed by the federal government. Because CLO funds are using investor dollars to purchase the loans – depositor assets, there is no taxpayer risk or risk of contagion arising from a default (or series of defaults) in a CLO.

References

1. See Collateralized Loan Obligation (CLO) Structure, Benefits, and Risks, Investopedia (updated Apr. 21, 2023) (available at https://www.investopedia.com/terms/c/clo.asp).