Leading Data Provider: Portfolios with Hedge Funds Do Better

Key Takeaways

Hedge funds provide significant diversification benefits—reducing risk for targeted return levels. Adding hedge funds to a portfolio helps significantly reduce risk for a given targeted return.

Analysis finds hedge funds are a proven tool to produce high risk-adjusted returns and generate alpha for portfolios.

Hedge funds provide valuable downside protection for their investors—including pensions, foundations, and endowments—helping them deliver for their beneficiaries in times of market volatility.

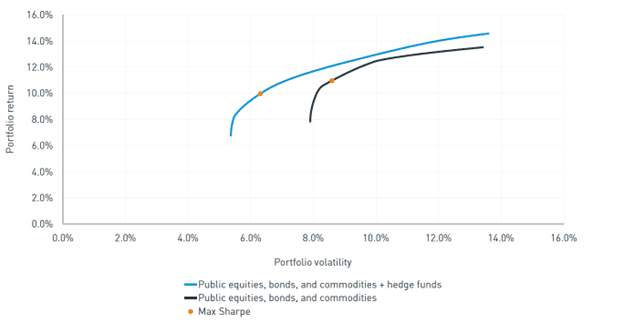

A new report from Preqin, a leading data provider, finds that hedge funds are an excellent tool to help an investor diversify their portfolio. The report, “Portfolio Allocation in Alternatives: Hedge Funds” uses historical data to assess the value of hedge funds in a portfolio. Preqin analyzed “efficient” portfolios, or ones that offered the highest returns for their underlying volatility. In other words, an efficient portfolio is one in which the only way to get a higher return is by taking more risk of losses.

To keep the results realistic, constrained were imposed on the mean-variance model: 70% maximum allocation on traditional public equities; 50% maximum allocation on public fixed income; and 20% maximum allocation on commodities as a low correlation/tactical layer. A 5% minimum and a 30% maximum constraint were also imposed on the hedge fund allocations. As shown in the graph above, the portfolios that included hedge funds dramatically outperformed on a risk-adjusted basis similar portfolios which only invested in stocks, bonds, and commodities. In other words, for every desired portfolio return, the portfolio with hedge funds had a lower volatility than the one without them. Out of the 100 most efficient portfolios, a large majority (78%) invested a full 30% of their assets in hedge funds, the maximum amount Preqin considered.

Characteristics of 10% Return Portfolios

| Portfolios Have Hedge Funds: | Yes | No |

|---|---|---|

| Volatility | 6.2% | 7.8% |

| Max Drawdown | -4.7% | -5.6% |

| % Positive Quarters | 83% | 77% |

Back testing the data between 2009-2021 and looking at a 10% target return, an investor would have had to been willing to endure 7.8% volatility in the portfolio without hedge funds, but only 6.2% with hedge funds. Similarly, the maximum portfolio loss was nearly 1% lower for the portfolio that included hedge funds, meaning the portfolio with hedge funds were able to absorb the shocks better than the portfolios that exclude them. The combination of lower volatility and fewer losses provides invaluable downside protection for institutional investors–including pensions, foundations, and endowments—helping them generate reliable returns to support their missions.

Portfolio Allocation in Alternatives: Hedge Funds is authored by Sam Monfared, PhD, CFA, CAIA, a VP in Preqin’s Research Insights team. This report is exclusively available to subscribers of Preqin’s institutional research, Preqin Insights+